Harvest season is here, and Rabobank analysts dig into the markets, policies and pricing

Rabobank, one of the world’s largest cooperative banks and a global leader specializing in food, agriculture and energy, today summarized the Fall Harvest Outlook for North America. Rabobank’s analysts suggest that in order to stay competitive in a global market during a time of tariff and trade war instability —and pull the industry out of its current trough—the annual harvest season might need to see a return to fundamentals.

“The U.S. is the number two producer and exporter of soybeans and has fallen out of China’s graces, who once purchased the majority of U.S. soy exports. Today, China is purchasing nearly 90 percent of its soybean demand from Brazil and none to date in 2025 from the U.S.,” said Stephen Nicholson Global Sector Strategist for Grains & Oilseeds, Farm Inputs, Rabobank. “While Brazil and Argentina have logistical challenges, the region is competitive due to a multi-crop season and cheaper labor. The shifting trade policies and tariffs could potentially damage trade flow in the long-term and in the short-term for producers.”

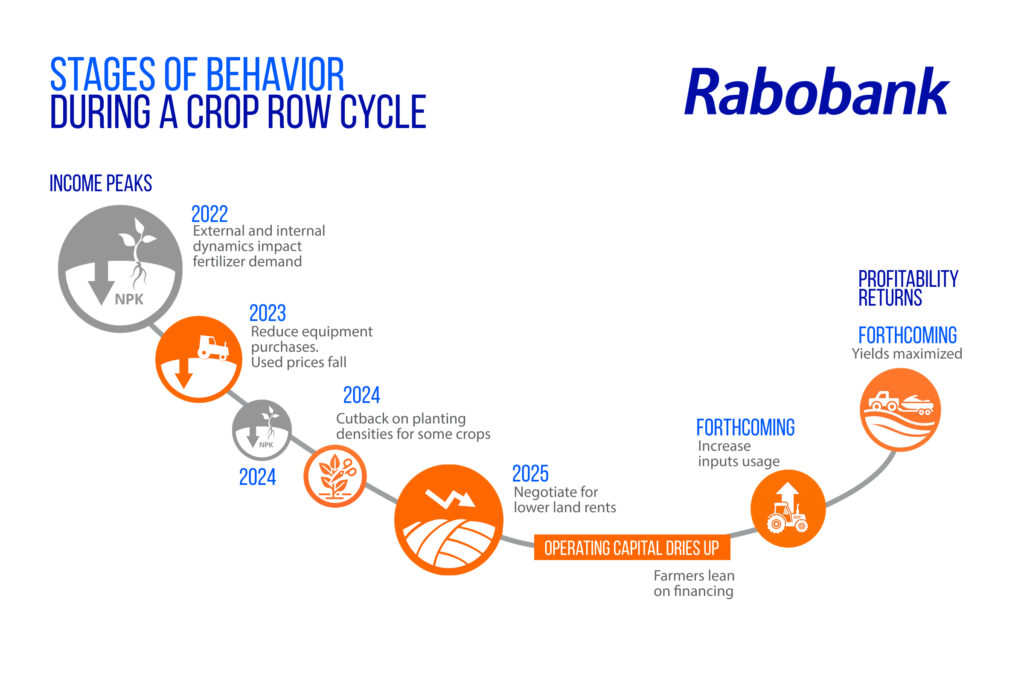

Rabobank’s Fall Harvest Outlook for North America explored the fundamentals, strains, opportunities and policy of the region’s grains, oilseeds, farm inputs and ag innovation sectors. The industry is experiencing tight farm margins, in part due to high input costs driven by high global demand for fertilizer exacerbated by supply shortages.

Sam Taylor, Farm Inputs Analyst, Rabobank stated, “With costs for growers in North America taking a divergent path from market returns, farmers face a quandary heading into 2026. Input pricing and demand are now at the behest and timing of government policy.”

The ever-increasing intervention of U.S. farm policy has increased uncertainty in the outlook for U.S. agriculture. The unintended consequences of government payments have led to ambiguity for buyers and future planting seasons. “Although enhanced government payments are well-intentioned, more dollars routed toward income support runs the risk of distorting markets, potentially delaying a recovery in the commodity cycle,” said Owen Wagner, Senior Grains & Oilseeds Analyst, Rabobank. Historically, government support had been counter cyclical—ramping up during periods of low market returns. Beginning with the 2008 Farm Bill, however, and excluding MFP and CFAP years, there was actually a positive correlation to returns and support – contributing to an inflationary environment in input markets.

Farmers who might look to explore alternative production methods are finding systemic barriers as the industry prioritizes high yield. Eric Gibson, Farm Inputs & Crop Production Sustainability, Analyst, Rabobank stated, “While adopting new, innovative solutions is often already a struggle, now producers are trying to figure out how they can navigate implementing changes without further tightening their balance sheets. Some opportunities exist which can improve production cost, but the ability to manage and mitigate risk will be a larger question to be considered.” Gibson’s recent report confronts the need for broader support to overcome barriers to adopting sustainable practices.

About Rabobank

Rabobank is one of the world’s largest cooperative banks and a global leader specializing in food, agriculture and energy.

In North America, Rabobank serves clients with corporate banking, agricultural and equipment financing solutions, leveraging its global strength and reach to provide knowledge and a competitive advantage across the entire food and energy value chain.