Here’s what you should know

Although US GDP may dip slightly into negative territory in Q3 2025, the US appears to have avoided a recession triggered by a full-scale trade war. A milder tariff regime may emerge as the new normal, with pulp and paper products among those affected. In response, producers should take a cautious approach, managing capacity and costs carefully, reassessing sourcing strategies to reduce exposure to tariffed imports, and strengthening domestic supply chains to improve resilience in a shifting trade landscape.

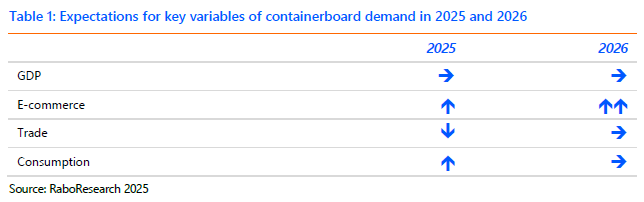

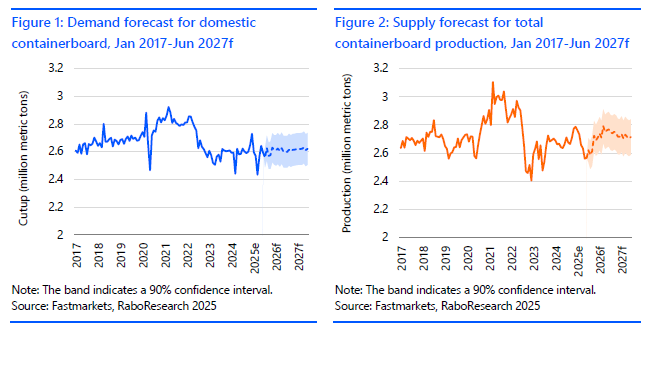

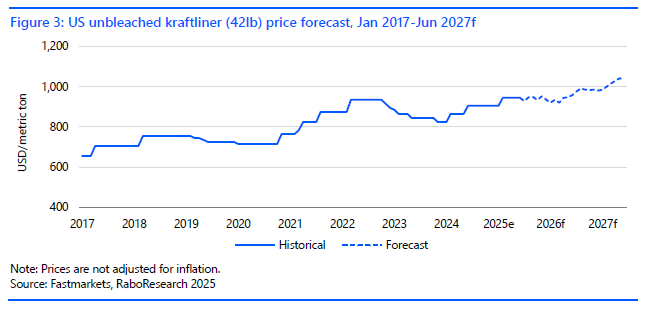

In the Q3 2025 edition of the containerboard forecast, we expect:

- Containerboard demand to recover at a modest rate of 0.53% CAGR through Q2 2027

- Production to recover at a rate of 2.82% CAGR, with inventory replenishment happening across mill and converters

Linerboard prices to remain flat in the next twelve months, followed by a projected USD 40/metric ton increase in late 2026 and another USD 50/metric ton increase in 2027

Mild tariff as the new normal

While it may still be too early to draw definitive conclusions, early signs suggest that a full-blown trade war has been avoided. Instead, we are facing a milder tariff environment, with rates of 10%-15% applied across a broad range of goods and trade partners. Among the affected sectors is pulp and paper, where European pulp now faces a 15% tariff and Brazilian pulp 10%. Notably, Brazilian pulp remains exempt from the more punitive 50% tariff schedule for other Brazilian imports currently. These changes are expected to raise the cost of imported goods – from raw materials to finished products – as well as logistics and manufacturing equipment, driving inflation throughout the supply chain and squeezing corporate earnings.

In the short term, inflation is projected to finish the year at 3%-4%, accompanied by lower disposable income and weaker GDP (see table 1). GDP is expected to be negative in Q3, weighed down disproportionately by declines in business and residential investment, both of which are sensitive to trade-related uncertainty. However, a modest recovery is expected in Q4. The consumer sector appears more resilient, with unemployment rising more slowly than anticipated despite notable white-collar layoffs.

At the same time, tariffs may soften export markets, increasing domestic supply across various paper grades and adding volatility to the paper packaging sector, which has already seen significant frontloading and pausing of activity. Over the medium term, these tariffs could erode the competitiveness of US exporters, leading to revenue declines and potential workforce reductions. Heightened policy uncertainty is also likely to dampen business investment, further constraining economic growth. Even if tariffs are eventually rolled back, the disruptions they cause may take several quarters to normalize. While initial assessments suggest US companies could gain a relative advantage and attract substantial investment, the long-term reputational impact on the US as a reliable trade partner remains unclear and could hurt pulp and paper exports.

Corrugated Demand to Slowly Improve

For Q3 2025, the forecast from our proprietary vector autoregression tool1 improved modestly. In the most likely scenario, we project a 0.53% CAGR in containerboard demand through Q2 2027 (see figure 1). The 90% confidence interval ranges from -1.7% to 2.7% annual growth. However, we expect the recovery to lean toward the upper end of that range.

E-commerce and GDP remain key drivers of containerboard demand. While GDP is expected to trend negatively in Q3 before gradually recovering, e-commerce sales have proven more resilient. Although sluggish private consumption may weigh on performance, we expect volumes in this channel to hold up relatively well, supported by increased promotional activity during the upcoming holiday season. Operating rates of linerboard have fluctuated in the high-80% range, but with the current forecast, we expect a gradual improvement over the next 12 months, reaching 92% by mid to late 2026. This implies a slow but steady recovery, likely driven by stabilizing demand in packaging and industrial sectors, easing inflationary pressures, and the potential normalization of trade disruptions. In the short term, however, continued demand volatility may pressure margins, particularly for producers with high fixed costs.

Pressure on Corrugated Production

The outlook for containerboard production has been revised downward to better reflect current domestic demand conditions and softer export expectations. In the most likely scenario, our forecast projects 2.82% annual growth in containerboard production through Q1 2027, with a 90% confidence interval ranging from 0.39% to 5.19% (see figure 2). This adjustment reflects a more cautious stance amid persistent macroeconomic headwinds. We expect the market to trend toward the lower end of the forecast range, given the wave of capacity reductions with no end in sight, including the most recent closures of International Paper’s Riverdale and Savannah mills. Given the challenging macroeconomic backdrop, we anticipate continued headwinds for containerboard supply, driven by an oversaturated market and persistently weak operating rates. While the actual trajectory of corrugated production may deviate from the modeled forecast, it reflects anticipated mill downtime, closures, and capacity optimization following recent acquisitions. These adjustments are expected to precede a modest recovery, which could support gradual restocking and renewed investment in operational efficiency. In the meantime, companies may need to remain cautious with capacity expansions and prioritize cost control until a more robust demand rebound materializes.

Price Hike Driven by Inflation

In our Q3 forecast, we project linerboard prices to remain flat through the first half of 2026, demonstrating resilience amid broader market softness. Unlike other paper grades that have seen price erosion, linerboard pricing is expected to hold steady, supported by relatively stable demand fundamentals and disciplined supply-side management. As market conditions begin to improve, we anticipate a net price increase of USD 40/metric ton in mid to late 2026, bringing the average price to USD 985/metric ton. This is expected to be followed by a further increase of USD 50/metric ton in 2027, lifting price expectations to USD 1,030/metric ton (see figure 3). These adjustments reflect a 4.71% GACR, much of which is attributed to inflationary pressures.

North American producers continue to benefit from strong bargaining power, enabling them to pass through cost increases, particularly those related to energy, labor, and transportation. Historical pricing behavior suggests that producers have successfully maintained margins during inflationary periods, and we expect similar dynamics to play out over the forecast horizon.

Note

The quantitative tool was developed by RaboResearch to forecast North American containerboard demand, supply, and prices in the next six to 24 months. It uses vector autoregression (VAR) – a statistical method that analyzes the predictive relationships between variables, such as GDP, e-commerce sales, consumption, trade data, etc. It allows users to interact with the variables and analyze their impacts, adjust the parameters according to specific market expectations, and test various hypotheses.

Disclaimer

This publication is issued by Coöperatieve Rabobank U.A., registered in Amsterdam, The Netherlands, and/or any one or more of its affiliates and related bodies corporate (jointly and individually: “Rabobank”). Coöperatieve Rabobank U.A. is authorised and regulated by De Nederlandsche Bank and the Netherlands Authority for the Financial Markets. Rabobank London Branch is authorised by the Prudential Regulation Authority (“PRA”) and subject to regulation by the Financial Conduct Authority and limited regulation by the PRA. Details about the extent of our regulation by the PRA are available from us on request. Registered in England and Wales No. BR002630. An overview of all locations from where Rabobank issues research publications and the (other) relevant local regulators can be found here: https://www.rabobank.com/knowledge/raboresearch-locations

The information and opinions contained in this document are indicative and for discussion purposes only. No rights may be derived from any transactions described and/or commercial ideas contained in this document. This document is for information purposes only and is not, and should not be construed as, an offer, invitation or recommendation. This document shall not form the basis of, or cannot be relied upon in connection with, any contract or commitment by Rabobank to enter into any agreement or transaction. The contents of this publication are general in nature and do not take into account your personal objectives, financial situation or needs. The information in this document is not intended, and should not be understood, as an advice (including, without limitation, an advice within the meaning of article 1:1 and article 4:23 of the Dutch Financial Supervision Act). You should consider the appropriateness of the information and statements having regard to your specific circumstances and obtain financial, legal and/or tax advice as appropriate. This document is based on public information. The information and opinions contained in this document have been compiled or arrived at from sources believed to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness.

The information and statements herein are made in good faith and are only valid as at the date of publication of this document or marketing communication. Any opinions, forecasts or estimates herein constitute a judgement of Rabobank as at the date of this document, and there can be no assurance that future results or events will be consistent with any such opinions, forecasts or estimates. All opinions expressed in this document are subject to change without notice. To the extent permitted by law Rabobank does not accept any liability whatsoever for any loss or damage howsoever arising from any use of this document or its contents or otherwise arising in connection therewith.

This document may not be reproduced, distributed or published, in whole or in part, for any purpose, except with the prior written consent of Rabobank. The distribution of this document may be restricted by law in certain jurisdictions and recipients of this document should inform themselves about, and observe any such restrictions.

A summary of the methodologies used by Rabobank can be found on our website.

Coöperatieve Rabobank U.A., Croeselaan 18, 3521 CB Utrecht, The Netherlands. All rights reserved

Authors

| Xinnan Li | Senior Analyst – Packaging and Logistics | xinnan.li@rabobank.com |

| Jean-Baptiste Verroken | Data Scientist – Packaging and Logistics | jean-baptiste.verroken@rabobank.com |