Summary

- On May 15, Banxico announced its decision to cut the overnight policy rate by 50bp from 9.00% to 8.50%.

- The decision was correctly anticipated by Bloomberg surveyed analysts, including ourselves, who were unanimous in our expectations.

- Banxico revised its inflation outlook upward for 2025, but still sees convergence to 0% in 2026.

- The Bank highlighted that the fight against inflation is now at the stage where the “aim is to bring inflation from its current level…to the 3% target,” and that “it took into account the behavior of the exchange rate, the weakness of economic activity and the possible impact of changes in trade policies worldwide.”

- The accompanying statement included the following phrase: “The Board estimates that looking ahead it could continue calibrating the monetary policy stance and consider adjusting it in similar magnitudes.” We believe that the Governing Board is eager to cut and see a 50bp cut at the next decision on June 26.

- Mexico currently faces 25% tariffs for non-USMCA compliant goods, in addition to tariffs on aluminum, steel, and autos. We believe that Mexico is likely to see some reduction in tariffs going forward and are optimistic to the outcome of Trump-Sheinbaum trade negotiations. However, a weakening consumer in the US is still likely to cause Mexico pain.

Mixed Messaging

Banxico decided to lower the target rate by 50bp from 9.00% to 8.50% on May 15. The tone of the statement was largely unchanged from recent decisions, highlighting the aim to reduce inflation from its current levels closer to the 3.0% target, as well as fears surrounding economic contraction and trade uncertainty.

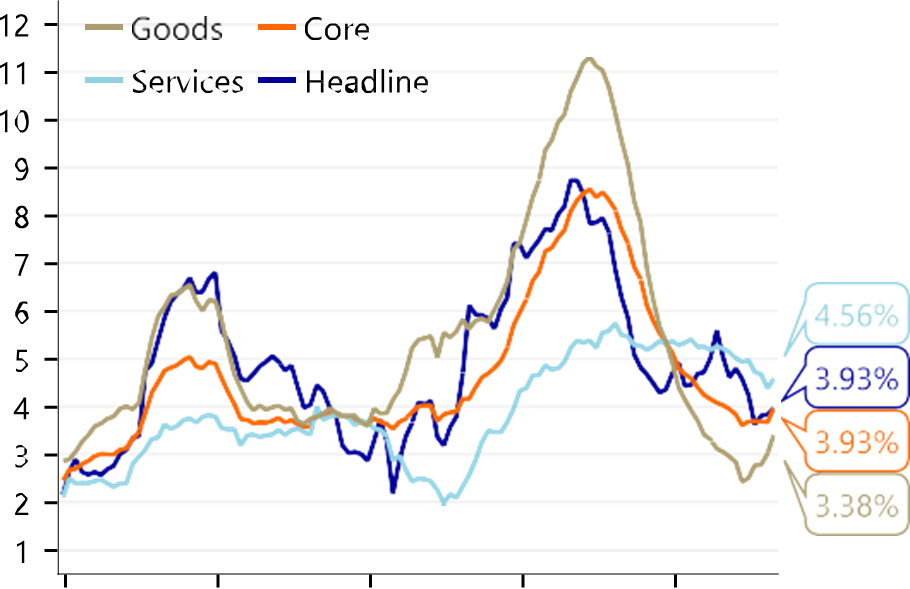

The Bank also revised its inflation forecasts upward for 2025, raising expectations for Q2 2025. In the headline CPI measure, the Bank adjusted its forecasts for Q2 2025 from 3.5% to 3.9% and Q3 from 3.4% to 3.5%. Meanwhile, the core measure was revised from 3.5% in Q2 to 3.9%, 3.4% in Q3 to 3.6%, and 3.3% in Q4 to 3.4%. These adjustments were driven by fears of rising merchandise prices. However, we will also note that Banxico still expects the headline measure to converge to 3.0% in Q3 2026 and expects the core measure to converge to 3.0% in Q2 2026.

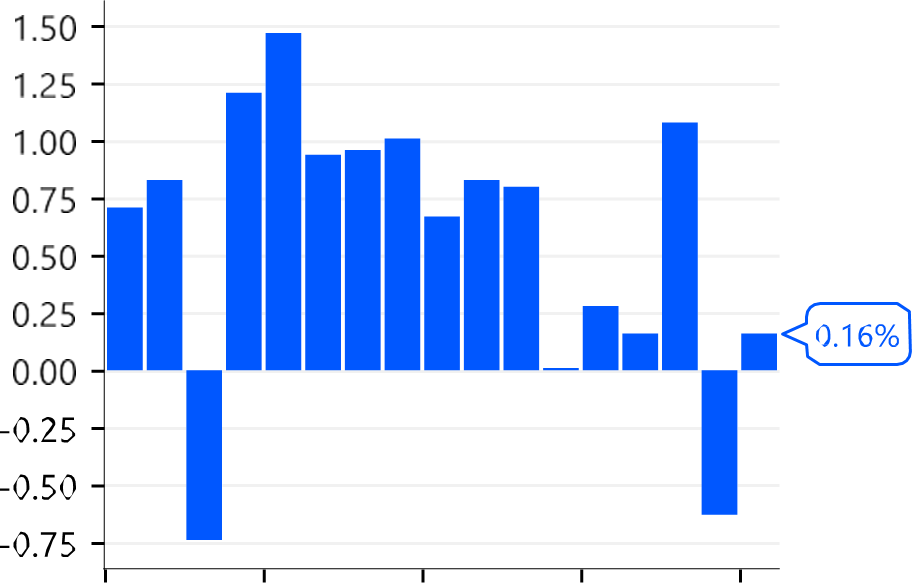

On the other hand, the economic picture in Mexico has deteriorated and outlook is bleak. Mexican GDP growth registered only 0.2% q/q in Q1 2025, and market uncertainty coupled with trade risk leaves little room for optimism. As noted previously, Mexico’s economy is heavily linked to that of the US, given that Mexican exports to the US account for around 40% of Mexican GDP. As such, Banxico noted that “prospects for world economic growth, particularly those for the US economy, have been revised downwards.” This suggests that even if the trade outlook for Mexico is positive, Mexico may still be negatively impacted by weakening consumer behavior in the US.

Banxico once again included the claim that “the Board estimates that looking ahead it could continue calibrating the monetary policy stance and consider adjusting it in similar magnitudes. It anticipates that the inflationary environment will allow to continue the rate cutting cycle, albeit maintaining a restrictive stance.” While Banxico would like to see inflation lower, the risks posed to economic activity are too great. We are forecasting a 50bp cut at the next meeting on June 26.

CPI inflation has been creeping higher…

… and GDP growth is slowing

Please see the Bank’s risks to its outlook below:

On the upside:

- foreign exchange depreciation;

- disruptions due to geopolitical conflicts or foreign trade policies;

- persistence of core inflation;

- cost-related pressures;

- climate relates impacts

On the downside:

- lower-than-anticipated economic activity;

- a lower pass-through effect from some cost-related pressures, and

- a lower-than-anticipated pas-through of the peso depreciation on inflation

Banxico’s CPI inflation projections

| 24Q3 | 24Q4 | 25Q1 | 25Q2 | 25Q3 | 25Q4 | 26Q1 | 26Q2 | 26Q3 | 26Q4 | 27Q1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Headline CPI | |||||||||||

| May 15 | 5.0 | 4.5 | 3.7 | 3.9 | 3.5 | 3.3 | 3.2 | 3.1 | 3.0 | 3.0 | 3.0 |

| Mar 27 | 5.0 | 4.5 | 3.7 | 3.5 | 3.4 | 3.3 | 3.2 | 3.1 | 3.0 | 3.0 | 3.0 |

| Core CPI | |||||||||||

| May 15 | 4.0 | 3.7 | 3.6 | 3.9 | 3.6 | 3.4 | 3.3 | 3.0 | 3.0 | 3.0 | 3.0 |

| Mar 27 | 4.0 | 3.7 | 3.6 | 3.5 | 3.4 | 3.3 | 3.2 | 3.0 | 3.0 | 3.0 | 3.0 |

Table 2: Rabobank FX Forecasts

| 15-May | 1m | 3m | 6m | 9m | 12m | |

|---|---|---|---|---|---|---|

| USD/MXN | 19.6 | 19.4 | 19.9 | 20.5 | 20.8 | 20.5 |

| EUR/MXN | 21.8 | 21.5 | 21.9 | 23.2 | 23.7 | 23.6 |

| EUR/USD | 1.11 | 1.11 | 1.10 | 1.13 | 1.14 | 1.15 |

Banxico Statements

May 15, 2025

Banco de México’s Governing Board decided to lower the target for the overnight interbank interest rate by 50 basis points to 8.50%, effective May 16, 2025. World economic growth is estimated to have expanded during the first quarter of 2025 at a rate lower than that observed in the previous quarter. In view of the foreign trade tensions, prospects for world economic growth, particularly those for the US economy, have been revised downwards. In this environment of high uncertainty, the US dollar depreciated. Short- and medium-term government interest rates ended the period with mixed results, after having decreased significantly along the yield curve. In most of the main advanced economies, headline and core inflation recently reverted part of the increases registered by both in early 2025. In its latest monetary policy decision, the US Federal Reserve left its reference rate unchanged. Among the most relevant global risks are the escalating trade tensions along with the intensification of geopolitical turmoil and their possible impact on inflation, on economic activity, and on volatility in financial markets. Since the previous monetary policy decision, Mexico’s government interest rates decreased, especially those for the short and medium terms. The Mexican peso appreciated, although it traded in a wide range. The Mexican economy exhibited weakness again during the first quarter of 2025. It registered a low seasonally adjusted quarterly growth rate of 0.2%, after having contracted in the previous quarter. The environment of uncertainty and trade tensions poses significant downward risks. Both headline and core inflation came in at 3.93% in April. Core inflation accumulated eight consecutive months below 4%, although, at the margin, it increased. Headline inflation expectations for the end of 2025 were revised upwards while those for longer terms remained relatively stable at levels above target. Inflation forecasts were adjusted upwards in the short term, mainly due to a greater-than-expected increase in merchandise inflation. Headline inflation is still expected to converge to the target in the third quarter of 2026 (see table). Forecasts are subject to the following risks. On the upside: i) foreign exchange depreciation; ii) disruptions due to geopolitical conflicts or foreign trade policies; iii) persistence of core inflation; iv) cost-related pressures; and v) climate-related impacts. On the downside: i) lower-than-anticipated economic activity; ii) a lower pass-through from some cost- related pressures, and iii) a lower-than-anticipated pass-through of the peso depreciation on inflation. Although the balance of risks for the trajectory of inflation within the forecast horizon remains biased to the upside, it has improved as the global shocks have been fading. The changes in economic policy by the new US administration have added uncertainty to the forecasts. Their effects could imply inflationary pressures on both sides of the balance. The Governing Board reiterated that, since the inflationary episode has been left behind, the fight against inflation is at a stage where the aim is to bring inflation from its current level, around its pre-pandemic historical average, to the 3% target. It considered that reference rate levels lower than those set as a 2 result of the global shocks are consistent with the challenges posed by the present stage. It took into account the behavior of the exchange rate, the weakness of economic activity and the possible impact of changes in trade policies worldwide. Considering the current inflationary outlook and the prevailing level of monetary restriction, with the presence of all its members, the Board decided unanimously to lower the target for the overnight interbank interest rate by 50 basis points to 8.50%. The Board estimates that looking ahead it could continue calibrating the monetary policy stance and consider adjusting it in similar magnitudes. It anticipates that the inflationary environment will allow to continue the rate cutting cycle, albeit maintaining a restrictive stance. It will take into account the effects of the country’s weak economic activity and the incidence of both the restrictive monetary policy stance that has been maintained and the stance prevailing in the future on the evolution of inflation throughout the horizon in which monetary policy operates. Actions will be implemented in such a way that the reference rate remains consistent at all times with the trajectory needed to enable an orderly and sustained convergence of headline inflation to the 3% target during the forecast period. The central bank reaffirms its commitment to its primary mandate and the need to continue its efforts to consolidate an environment of low and stable inflation.

March 27, 2025

Banco de México’s Governing Board decided to lower the target for the overnight interbank interest rate by 50 basis points to 9.00%, effective March 28, 2025.

Prospects for world economic growth were revised downwards, including those for the US economy. The adjustments were partly due to various announcements on the imposition of tariffs. In early 2025, inflation exhibited a mixed behavior across the main advanced economies. In its latest monetary policy decision, the US Federal Reserve left its reference rate unchanged. Government interest rates performed differently by region and the US dollar depreciated. Global risks continued increasing. Among these are the escalating trade tensions and the intensification of geopolitical turmoil, and their possible impact on inflation, on the economic weakening, and on volatility in financial markets.

Since the previous monetary policy decision, Mexico’s government interest rates decreased in all terms. The Mexican peso slightly appreciated, although it traded in a wide range. The Mexican economy is expected to exhibit weakness once again in the first quarter of 2025. The environment of uncertainty and trade tensions poses significant downward risks.

Headline inflation remained at levels unseen since early 2021, reaching 3.67% in the first fortnight of March 2025. Core inflation registered 3.56% during the same period, slightly below its average level between 2003 -when the 3% permanent target was set- and 2019. Headline inflation expectations for the end of 2025 decreased while those for longer terms remained relatively stable at levels above target.

Inflation forecasts remain unchanged and headline inflation is still expected to converge to the target in the third quarter of 2026 (see table). Forecasts are subject to the following risks. On the upside: i) foreign exchange depreciation; ii) disruptions due to geopolitical conflicts or foreign trade policies; iii) persistence of core inflation; iv) cost-related pressures; and v) climate-related impacts. On the downside: i) lower-than-anticipated economic activity; ii) a lower pass-through from some cost-related pressures, and iii) a lower-than-anticipated pass-through of the peso depreciation on inflation. Although the balance of risks for the trajectory of inflation within the forecast horizon remains biased to the upside, it has improved.

The changes in economic policy by the new US administration have added uncertainty to the forecasts. Its effects could imply inflationary pressures on both sides of the balance.

The Governing Board deemed that the disinflation process remains well on track and reiterated that the fight against inflation is at a stage where the aim is to bring inflation from its current level, around its prepandemic historical average, to the 3% target. It considered that reference rate levels lower than those set as a result of the global shocks are consistent with the challenges posed by the present stage, including the possible impact of changes in trade policies worldwide. Taking into account the current inflationary outlook and the prevailing level of monetary restriction, with the presence of all its members, the Board decided unanimously to lower the target for the overnight interbank interest rate by 50 basis points to 9.00%. 2 The Board estimates that looking ahead it could continue calibrating the monetary policy stance and consider adjusting it in similar magnitudes. It anticipates that the inflationary environment will allow to continue the rate cutting cycle, albeit maintaining a restrictive stance. It will take into account the effects of the country’s weak economic activity and the incidence of both the restrictive monetary policy stance that has been maintained and the stance prevailing in the future on the evolution of inflation throughout the horizon in which monetary policy operates. Actions will be implemented in such a way that the reference rate remains consistent at all times with the trajectory needed to enable an orderly and sustained convergence of headline inflation to the 3% target during the forecast period. The central bank reaffirms its commitment to its primary mandate and the need to continue its efforts to consolidate an environment of low and stable inflation.

Authors

Christian Lawrence

Head of Cross-Asset Strategy

+1 212 808 6923

Molly Schwartz

Cross-Asset Strategist

+1 212 926 7968

Global Economics and Markets

Global Head

Jan Lambregts

+44 20 7664 9669

Jan.Lambregts@Rabobank.com

Macro Strategy

Global

Michael Every

Senior Macro Strategist

Michael.Every@Rabobank.com

Europe

Elwin de Groot

Head Macro Strategy Eurozone, ECB

+31 30 712 1322

Elwin.de.Groot@Rabobank.com

Bas van Geffen

Senior Macro Strategist ECB, Eurozone

+31 30 712 1046

Bas.van.Geffen@Rabobank.com

Stefan Koopman

Senior Macro Strategist UK, Eurozone

+31 30 712 1328

Stefan.Koopman@Rabobank.com

Maartje Wijffelaars

Senior Economist Italy, Spain, Eurozone

+31 88 721 8329

Maartje.Wijffelaars@Rabobank.nl

Americas

Philip Marey

Senior Macro Strategist

United States, Fed

+31 30 712 1437

Philip.Marey@Rabobank.com

Christian Lawrence

Head of Cross-Asset Strategy

Canada, Mexico

+1 212 808 6923

Christian.Lawrence@Rabobank.com

Mauricio Une

Senior Macro Strategist

Brazil, Chile, Peru

+55 11 5503 7347

Mauricio.Une@Rabobank.com

Renan Alves

Macro Strategist Brazil

+55 11 5503 7288

Renan.Alves@Rabobank.com

Molly Schwartz

Cross-Asset Strategist

+1 516 640 7372

Molly.Schwartz@Rabobank.com

Asia, Australia & New Zealand

Teeuwe Mevissen

Senior Macro Strategist China

+31 30 712 1509

Teeuwe.Mevissen@Rabobank.com

Benjamin Picton

Senior Macro Strategist Australia, New Zealand

+61 2 8115 3123

Benjamin.Picton@Rabobank.com

FX Strategy

Jane Foley

Head FX Strategy G10 FX

+44 20 7809 4776

Jane.Foley@Rabobank.com

Rates Strategy

Richard McGuire

Head Rates Strategy

+44 20 7664 9730

Richard.McGuire@Rabobank.com

Lyn Graham-Taylor

Senior Rates Strategist

+44 20 7664 9732

Lyn.Graham-Taylor@Rabobank.com

Credit Strategy & Regulation

Matt Cairns

Head Credit Strategy & Regulation

Covered Bonds, SSAs

+44 20 7664 9502

Matt.Cairns@Rabobank.com

Bas van Zanden

Senior Analyst Pension funds, Regulation

+31 30 712 1869

Bas.van.Zanden@Rabobank.com

Cas Bonsema

Senior Analyst Financials

+31 6 127 66 642

Cas.Bonsema@Rabobank.com

Maartje Schriever

Analyst ABS

+31 6 251 43 873

Maartje.Schriever@Rabobank.com

Agri Commodity Markets

Carlos Mera

Head of ACMR

+44 20 7664 9512

Carlos.Mera@Rabobank.com

Charles Hart

Senior Commodity Analyst

+44 20 7809 4245

Charles.Hart@Rabobank.com

Oran van Dort

Commodity Analyst

+31 6 423 80 964

Oran.van.Dort@Rabobank.com

Andrick Payen

RaboResearch Analyst

+1 212 808 6808

Andrick.Payen@Rabobank.com

Energy Markets

Joe DeLaura

Senior Energy Strategist

+1 212 916 7874

Joe.DeLaura@Rabobank.com

Florence Schmit

Energy Strategist

+44 20 7809 3832

Florence.Schmit@Rabobank.com

Disclaimer

Non Independent Research

This document is issued by Coöperatieve Rabobank U.A. incorporated in the Netherlands, trading as “Rabobank” (“Rabobank”) a cooperative with excluded liability. The liability of its members is limited. Authorised by De Nederlandsche Bank in the Netherlands and regulated by the Authoriteit Financiële Markten. Rabobank London Branch (RL) is authorised by De Nederlandsche Bank, the Netherlands and the Prudential Regulation Authority, and subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Further details are available on request. RL is registered in England and Wales under Company no. FC 11780 and under Branch No. BR002630. This document is directed exclusively to Eligible Counterparties and Professional Clients. It is not directed at Retail Clients.

This document does not purport to be impartial research and has not been prepared in accordance with legal requirements designed to promote the independence of Investment Research and is not subject to any prohibition on dealing ahead of the dissemination of Investment Research. This document does NOT purport to be an impartial assessment of the value or prospects of its subject matter and it must not be relied upon by any recipient as an impartial assessment of the value or prospects of its subject matter. No reliance may be placed by a recipient on any representations or statements made outside this document (oral or written) by any person which state or imply (or may be reasonably viewed as stating or implying) any such impartiality.

This document is for information purposes only and is not, and should not be construed as, an offer or a commitment by RL or any of its affiliates to enter into a transaction. This document does not constitute investment advice and nor is any information provided intended to offer sufficient information such that is should be relied upon for the purposes of making a decision in relation to whether to acquire any financial products. The information and opinions contained in this document have been compiled or arrived at from sources believed to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness.

The information contained in this document is not to be relied upon by the recipient as authoritative or taken in substitution for the exercise of judgement by any recipient. Any opinions, forecasts or estimates herein constitute a judgement of RL as at the date of this document, and there can be no assurance that future results or events will be consistent with any such opinions, forecasts or estimates. All opinions expressed in this document are subject to change without notice.

To the extent permitted by law, neither RL, nor other legal entities in the group to which it belongs accept any liability whatsoever for any direct or consequential loss howsoever arising from any use of this document or its contents or otherwise arising in connection therewith.

Insofar as permitted by applicable laws and regulations, RL or other legal entities in the group to which it belongs, their directors, officers and/or employees may have had or have a long or short position or act as a market maker and may have traded or acted as principal in the securities described within this document (or related investments) or may otherwise have conflicting interests. This may include hedging transactions carried out by RL or other legal entities in the group, and such hedging transactions may affect the value and/or liquidity of the securities described in this document. Further it may have or have had a relationship with or may provide or have provided corporate finance or other services to companies whose securities (or related investments) are described in this document.

Further, internal and external publications may have been issued prior to this publication where strategies may conflict according to market conditions at the time of each publication.

This document may not be reproduced, distributed or published, in whole or in part, for any purpose, except with the prior written consent of RL. By accepting this document you agree to be bound by the foregoing restrictions. The distribution of this document in other jurisdictions may be restricted by law and recipients of this document should inform themselves about, and observe any such restrictions.

A summary of the methodology can be found on our website

© Rabobank London, Thames Court, One Queenhithe, London EC4V 3RL +44(0) 207 809 3000