Trade disruption creates uncertainty and unpredictability

Since President Trump took office in early 2025, uncertainty and unpredictability have reverberated through global markets, including the global beef market. With beef as one of the largest agricultural commodities traded by the United States, any change to US trading arrangements has the potential to affect the beef market at a national and, in turn, a global level. At the time of writing, the full extent of the tariffs has not been finalized, as the 90-day pause is due to expire in early July. Nevertheless, we provide some initial thoughts on the potential implications of trade-disrupting tariffs or any potential agreements that may be forthcoming.

Without beef being singled out as a targeted commodity and with most major exporters only facing baseline tariffs, early indications suggest that competitive positions will be maintained, albeit with added costs to the system. With the global supply and demand situation, we expect trade flows to be maintained. However, this is likely to change if major trading blocs such as Europe and China become involved in a trade war with the United States.

Australia/New Zealand

The United States is currently the largest beef export market for Australia and New Zealand.

While RaboResearch believes there is a relatively low likelihood of any specific tariff action against Australia or New Zealand, both countries have received the 10% baseline tariff. This will add costs to the supply chain. But the lean beef trimmings primarily exported by these countries matches the lower availability of US trimmings. That should allow export volumes to remain relatively steady, and the additional costs are more likely borne by the consumer end of the supply chain. Bigger implications for Australia and New Zealand beef trade revolve around the US-China relationship and any possible change to Chinese trading agreements.

Brazil/Argentina

The 10% tariff imposed has added costs to Brazilian and Argentinian exports to the United States. Brazil exports were already facing a 26.4% tariff due to fulfilment of the “other country” quota. With US supply contractions, larger volumes of Brazilian and Argentinean beef have been imported. In 2024, Brazil exports increased by 66% to 230,000mt and Argentinian exports increased by 44% to 34,000mt. Brazil export volumes to the US in April (48,000mt) were the highest in history suggesting the additional tariffs are not affecting trade. Any reduction in US volumes to China could give Brazil the opportunity to increase volumes exported to the Chinese market.

Brazil will also be paying close attention to any US reciprocal tariff arrangements with Japan. If the United States and Japan do not form an agreement, this may be cause for Japan to seek out other suppliers, possibly opening the door for Brazil.

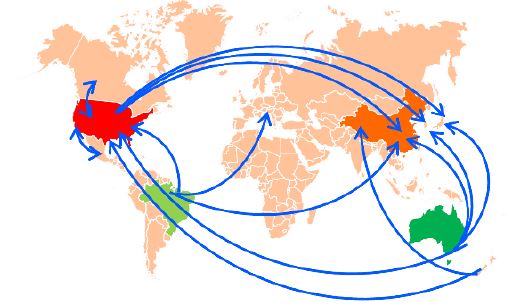

Major beef trade routes

China

Talks between China and the United States resulted in a pause on additional tariffs until early August, although China still has a 20% tariff in place. This tariff has added to the already higher price of US beef and is expected to see a drop in US volumes imported. In addition to the tariffs, China is yet to reinstate the registration of US beef exporting plants to allow them to export to China. The overall impact on the China beef market is expected to be small – the US accounted for 4.8% of China’s total beef imports in 2024 – but there will be some impact on certain supply channels, such as premium steakhouses. Other countries such as Australia are expected to fill some of the gaps from reduced US imports but overall Chinese imports are expected to see a small decline in 2025 due to weak domestic demand. The Chinese investigation into imported beef that was announced in December 2024 is ongoing and may last into Q3 2025. This has the potential to lead the policy change, such as volume limits or tariffs.

Europe

Europe’s beef imports may be indirectly affected by US tariffs and the response from other countries. If China pursues more imports from South American countries, Australia, and New Zealand, this could impact the availability and price of beef imports into Europe. Brazil represents over 30% of total EU27+UK beef imports, Argentina 18%, and Uruguay 12%. Beef carcass prices in Europe are at record highs due to tighter supply and relatively high demand, particularly for lean beef trimmings.

United States

The US beef industry is largely domestic focused, limiting some the risk that tariff and trade policy has on the US beef sector and consumers. Beef imports, including beef produced from imported Mexican and Canadian cattle, account for around 18% of domestic consumption. Canadian and Mexican trade arrangements are continuing as negotiated through the USMCA, and at this stage are tariff-free. However, tensions between these countries need to be monitored. A 10% tariff applied to beef imports means (based on averages) 7.5% of US beef consumption would see a USc 31.5/lb increase. Applied across the entire sector, this would be about USc 2.5/lb. The US beef consumer is likely to see bigger price movements due to domestic supply and demand pressures. Around 11-12% of US domestic beef production is exported annually, with China being a top 3 market. Exports to China have been declining due to higher US prices (tariffs make these even more unaffordable) and the non-renewal of export accreditation for US beef processing plants is a setback to hide and variety meat values.

Tariffs may just be the beginning

While much of the media attention has been on the imposition of tariffs, this may only be the opener to the main event. In just a few months, countries have entered trade talks with 30-day timeframes. The result has been more trade agreements than we’ve seen in decades. While tariffs may have grabbed headlines and caused headaches, the implications of shifting global trade dynamics.

Tariff implementation timeline – beef relevant tariff lines

Authors

Lead author:

Angus Gidley-Baird – Australia

angus.gidley-baird@rabobank.com

Contributing authors:

Éva Gocsik – Europe

eva.gocsik@rabobank.com

Lance Zimmerman – North America

lance.zimmerman@raboag.com

Kousei Hasagawa – Japan

hasagawa@nochuri.co.jp

Chenjun Pan – China

chenjun.pan@rabobank.com

Wagner Yanaguizawa – Brazil

wagner.yanaguizawa@rabobank.com

Jen Corkran – New Zealand

jen.corkran@rabobank.com

Pablo Sherwell – Mexico

pablo.sherwell@rabobank.com

Mr Hasegawa is an Analyst at the Norinchukin Research Institute, a part of Norinchukin Bank, Japan. He and Mr Hideki Obata have contributed to this quarterly under the terms of the partnership agreement between Rabobank and Norinchukin Bank.

Other Global Animal Protein Sector Team Members:

| Anna Drake – Australia

Charlotte Talbott – North America Charlotte.Talbott@rabobank.com |

Christine McCracken – North America

christine.mccracken@rabobank.com Gorjan Nikolik – Europe gorjan.nikolik@rabobank.com |

Nan-Dirk Mulder – Europe

Novel Sharma– Europe novel.sharma@rabobank.com |

Disclaimer

This document is meant exclusively for you and does not carry any right of publication or disclosure other than to Coöperatieve Rabobank U.A. (“Rabobank”), registered in Amsterdam. Neither this document nor any of its contents may be distributed, reproduced, or used for any other purpose without the prior written consent of Rabobank. The information in this document reflects prevailing market conditions and our judgement as of this date, all of which may be subject to change. This document is based on public information. The information and opinions contained in this document have been compiled or derived from sources believed to be reliable; however, Rabobank does not guarantee the correctness or completeness of this document, and does not accept any liability in this respect. The information and opinions contained in this document are indicative and for discussion purposes only. No rights may be derived from any potential offers, transactions, commercial ideas, et cetera contained in this document. This document does not constitute an offer, invitation, or recommendation. This document shall not form the basis of, or cannot be relied upon in connection with, any contract or commitment whatsoever. The information in this document is not intended, and may not be understood, as an advice (including, without limitation, an advice within the meaning of article 1:1 and article 4:23 of the Dutch Financial Supervision Act). This document is governed by Dutch law. The competent court in Amsterdam, the Netherlands has exclusive jurisdiction to settle any dispute which may arise out of, or in connection with, this document and/or any discussions or negotiations based on it. This report has been published in line with Rabobank’s long-term commitment to international food and agribusiness. It is one of a series of publications undertaken by the global department of RaboResearch Food & Agribusiness. @ 2025 – All Rights Reserved.