Did Trump Put Tariffs on Russia? How Tariff Threats Impact the Global Economy

President Donald Trump has not directly imposed tariffs on Russia, although there are threats to impose secondary sanctions on Moscow’s trading partners who purchase Russian oil. The Trump administration has stated that the president will use executive orders to implement these tariffs if the Kremlin does not agree to a ceasefire in Ukraine (with a sit-down between US President Donald Trump and Russian President Vladimir Putin, but not Ukrainian President Volodymyr Zelenskyy) by August 8, 2025. The White House claims these additional tariffs are a response to the Russian invasion of Ukraine and to tighten national security concerns. There are worries among US trade partners that higher tariff rates will significantly impact the global economy, leading to higher prices, reciprocal tariffs, and supply chain issues as many countries depend on Russian oil and natural gas products, including China, India, Türkiye, European Union member states, Japan, and Brazil. Economists also express concerns that harsher tariff policies on US imports could lead to greater financial strain in both the US and abroad.

Economic Impact of New Potential Trump Tariffs

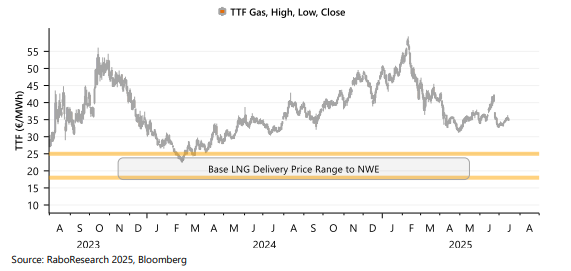

European gas markets have remained relatively stable despite the threat of a new trade war with increases on current import taxes, trading between €33–35/MWh since the Israel-Iran ceasefire on June 23, reflecting steady supply and modest demand growth. However, geopolitical tensions briefly disrupted this calm. U.S. President Trump’s threat of renewed Russia sanctions and US tariffs initially lifted energy prices on July 11, but markets quickly reversed on a more tempered stance. TTF gas and Brent crude fell about 3.6% the following Monday, as fears of extreme tariffs (up to 500%) faded. Even a 100% secondary tariff remains unlikely due to its potential to severely disrupt global energy flows and spike prices.

Meanwhile, Europe’s gas fundamentals are tightening. High cooling demand in Asia is pulling LNG cargoes away from Europe, creating a supply squeeze as the EU works to reach 80% gas storage before winter (currently at 63%). LNG imports have fallen from over 385 mcm/d to 363 mcm/d, while JKM prices have risen to a $1.20/MMBtu premium over TTF, making it harder for Europe to compete for supply amongst increasingly aggressive potential trade deals and tightening supplies.

The EU’s latest sanctions package mainly targets Russian oil revenue, not gas, and is expected to have minimal direct market impact. Still, uncertainty around Norwegian gas maintenance in late August and possible further sanctions could introduce price volatility. Countries like Slovakia, Hungary, and others remain reliant on Russian energy, highlighting the EU’s ongoing challenge in balancing sanctions with energy security.

For now, Asian demand—not geopolitics—is the key driver of European gas prices and remains a key component of bilateral trade talks and trade agreements.

To learn more about how threats of new tariffs impact global trade, supply line security, and the future of US trade policy during Trump’s second term and beyond, please read our exclusive report.

Full Report

Disclaimer

Non Independent Research

This document is issued by Coöperatieve Rabobank U.A. incorporated in the Netherlands, trading as “Rabobank” (“Rabobank”) a cooperative with excluded liability. The liability of its members is limited. Authorised by De Nederlandsche Bank in the Netherlands and regulated by the Authoriteit Financiële Markten. Rabobank London Branch (RL) is authorised by De Nederlandsche Bank, the Netherlands and the Prudential Regulation Authority, and subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Further details are available on request. RL is registered in England and Wales under Company no. FC 11780 and under Branch No. BR002630. This document is directed exclusively to Eligible Counterparties and Professional Clients. It is not directed at Retail Clients.

This document does not purport to be impartial research and has not been prepared in accordance with legal requirements designed to promote the independence of Investment Research and is not subject to any prohibition on dealing ahead of the dissemination of Investment Research. This document does NOT purport to be an impartial assessment of the value or prospects of its subject matter and it must not be relied upon by any recipient as an impartial assessment of the value or prospects of its subject matter. No reliance may be placed by a recipient on any representations or statements made outside this document (oral or written) by any person which state or imply (or may be reasonably viewed as stating or implying) any such impartiality.

This document is for information purposes only and is not, and should not be construed as, an offer or a commitment by RL or any of its affiliates to enter into a transaction. This document does not constitute investment advice and nor is any information provided intended to offer sufficient information such that is should be relied upon for the purposes of making a decision in relation to whether to acquire any financial products. The information and opinions contained in this document have been compiled or arrived at from sources believed to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness.

The information contained in this document is not to be relied upon by the recipient as authoritative or taken in substitution for the exercise of judgement by any recipient. Any opinions, forecasts or estimates herein constitute a judgement of RL as at the date of this document, and there can be no assurance that future results or events will be

consistent with any such opinions, forecasts or estimates. All opinions expressed in this document are subject to change without notice.

To the extent permitted by law, neither RL, nor other legal entities in the group to which it belongs accept any liability whatsoever for any direct or consequential loss howsoever arising from any use of this document or its contents or otherwise arising in connection therewith.

Insofar as permitted by applicable laws and regulations, RL or other legal entities in the group to which it belongs, their directors, officers and/or employees may have had or have a long or short position or act as a market maker and may have traded or acted as principal in the securities described within this document (or related investments) or may otherwise have conflicting interests. This may include hedging transactions carried out by RL or other legal entities in the group, and such hedging transactions may affect the value and/or liquidity of the securities described in this document. Further it may have or have had a relationship with or may provide or have provided corporate finance or other services to companies whose securities (or related investments) are described in this document. Further, internal and external publications may have been issued prior to this publication where strategies may conflict according to market conditions at the time of each publication.

This document may not be reproduced, distributed or published, in whole or in part, for any purpose, except with the prior written consent of RL. By accepting this document you agree to be bound by the foregoing restrictions.

The distribution of this document in other jurisdictions may be restricted by law and recipients of this document should inform themselves about, and observe any such restrictions.

A summary of the methodology can be found on our website

© Rabobank London, Thames Court, One Queenhithe, London EC4V 3RL +44(0) 207 809 300

Full Report

European gas markets briefly returned to trading based on fundamentals after U.S. President Donald Trump announced a ceasefire between Israel and Iran on 23 June, resulting in a more than 12% drop in TTF gas prices day-on-day. Three weeks on, markets have been trading in a narrow €33–35/MWh range, reflecting stable pipeline and liquefied natural gas supply versus only a small increase in gas demand.

Yet geopolitics are making a comeback—even if only briefly—as President Trump announced a potential further tightening of sanctions against Russia while also increasing tariff pressures on global trading partners, including the EU. Energy markets rose on Friday, 11 July, as news about a potential imposition of so-called secondary tariffs on Russia emerged, but quickly reversed these gains on Monday after Trump threatened a 100% rate if “we don’t have a deal in 50 days.” U.S. Ambassador to NATO Matt Whitaker said this would represent secondary sanctions on countries

buying oil from Russia. The announcement echoes secondary tariffs proposed in a bipartisan bill in Congress, which would have opened the door for a 500% tariff on imports from countries purchasing Russian gas, oil, and uranium. Monday’s announcement signals a more tempered response, with energy markets lower as a result. TTF gas prices fell by about 3.6% during the day and touched a session low of €35.02/MWh, while Brent crude oil prices fell by the same amount, dropping back below $69.50/bbl. The threat of a 500% secondary tariff on Russian oil and gas floated at the end of last week has all but evaporated – along with the belief that any secondary tariff of this magnitude would actually be enforced.

Yet, imposing even a 100% secondary tariff on Russian energy is bullish for both crude and gas markets, given Russia’s significant share of global energy supply, and would hurt buyers from Asia to Europe. India, China, and Turkey are major Russian oil buyers, and Europe still relies on pipeline supplies despite a ban on seaborne imports in place since 2022. The picture is similar for gas, with China and Japan among the top importers of Russian pipeline and LNG volumes, while European buyers—from France and Spain to Hungary—also heavily rely on Russian flows. Having to look for alternative gas supplies would only tighten the global LNG market further. The imposition of such a tariff rate is therefore incredibly unlikely, as it would either halt trade between the U.S. and its major trading partners or send energy prices soaring if buyers were to refrain from purchasing Russian volumes. The 50-day pause also coincides with the start of Norway’s seasonal gas maintenance in late August, which could introduce fresh uncertainty for European gas markets heading into autumn.

While markets have until September (or so) to find out if—and at what rate—these secondary tariffs will be set, Slovakia will discuss the future of Russian gas supplies with EU partners on Tuesday, aiming to be compensated for damages incurred from the EU’s tightening grip on Russian gas imports. Slovakia still receives most of its gas from Russia and has a long-term offtake agreement in place that runs until 2034. But the country is not the only member state still reliant on Russian gas imports. While Russian pipeline gas accounted for only 3% of the European supply mix so far this year, Russian LNG volumes still made up almost 14% of all LNG imports. France, Spain, Belgium, and the Netherlands remain top importers of Russian LNG. Slovakia and Hungary also remain key importers of Russian oil. The EU’s 18th sanctions package against Russia aims to enforce a lower price cap on Russian seaborne crude flows, as well as tighter sanctions on refined product imports from third countries.

European gas prices are currently hovering around €35/MWh, with the surge in cooling demand across Asia—particularly in Northeast Asia due to extreme summer heat—keeping prices elevated. This spike in demand is slowly drawing LNG cargoes away from Europe, as Asian buyers outbid European counterparts to secure supply for power generation needed to run air conditioning systems.

This redirection of LNG flows is adding to a supply squeeze in Europe, especially during a period when the continent still needs to build reserves for the winter. Although European gas storage levels are currently filled to almost 63% of capacity, the region still needs to import roughly 20bcm to reach the 80% storage target. The increased competition from Asia and rising domestic consumption are narrowing any supply cushion. LNG flows to Europe have dropped to 363 mcm/d in July, from over 385 mcm/d a month earlier, and remain well below the year-to-date average. News about tightening sanctions on Russian energy could support gas prices in Europe if implemented—but for now, markets will be supported by fundamentals—namely, stronger demand in Asia. JKM prices have moved to a more than $1.20/MMBtu premium to the TTF in July so far

Figure 1: TTF gas prices dropped by 12% after the announcement of the Israel-Iran ceasefire and have held at a steady €33-35/MWh range since. Monday’s 100% secondary tariff threat on Russia saw prices tumble another 1.4%