- We expect the FOMC to keep the target range for the federal funds rate unchanged at 4.25- 4.50% at the meeting on July 29-30 as the majority of the Committee is waiting for more clarity about trade policy and the impact of tariffs on the economy.

- The expected impact of the tariffs is pulling the Fed in two opposite directions. On balance, we think that the Fed will therefore be slow and modest in its reactions in 2025. For now, we still expect only one rate cut in the remainder of the year, most likely in September.

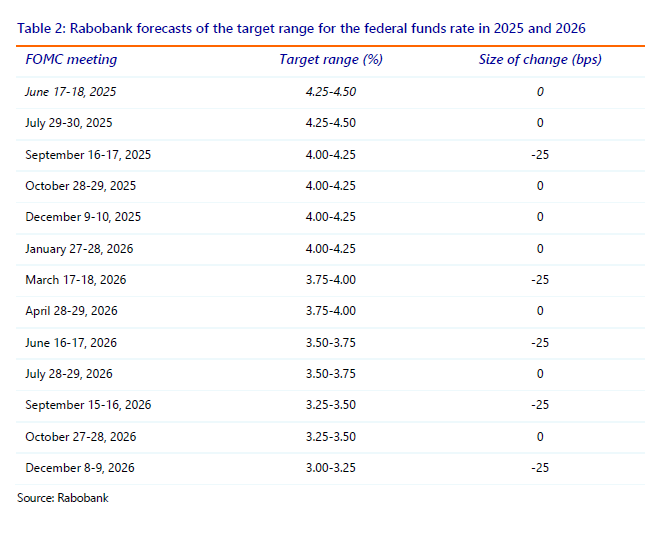

- However, looking ahead to next year, we expect Trump’s impact on monetary policy to increase as Governor Kugler is replaced before the March meeting and a Trump-loyalist chairs the June meeting. While the remaining FOMC participants should in theory be able to limit Trump’s impact, the recent behavior of Waller and Bowman suggests that Trump has already gained a foothold in the FOMC. This means that we now expect more rate cuts in 2026 than we had earlier anticipated when we assumed that the FOMC would be able to keep monetary policy free from Trump’s influence.

Introduction

The next meeting of the FOMC takes place on July 29-30. We expect the Committee to keep the target range for the federal funds rate unchanged at 4.25-4.50% as the majority of the Committee is waiting for more clarity about trade policy and the impact of tariffs on the economy. There will be no new projections, so we only have the formal statement and Powell’s post-meeting press conference to look forward to. During the press conference Powell is likely to repeat that the Committee is waiting for more clarity about trade policy and the impact of tariffs on the economy.

The Fed’s dilemma in 2025

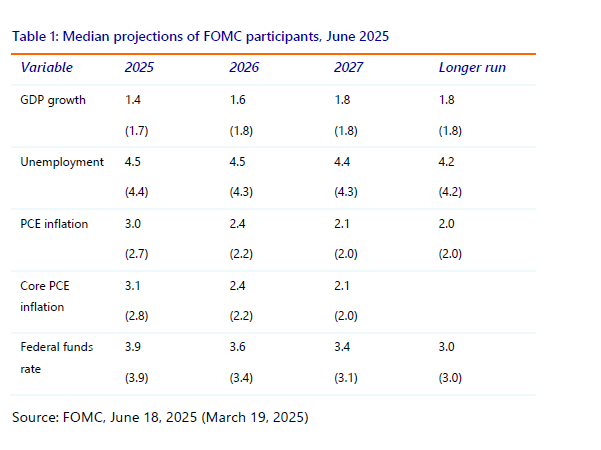

Powell has repeatedly said that the Fed is waiting for more clarity about trade policy and the impact of tariffs on the economy. The FOMC would like to address the part of the dual mandate that shows the largest and most persistent deviation. At the same time, the Committee wants to prevent tariffs from turning from a one time price increase to something more persistent. Keeping long term inflation expectations anchored is crucial and price stability is a necessary condition for sustained maximum employment. This supports our view that Powell sees only limited scope for rate cuts. At the June post-meeting press conference, Powell said it is hard to say when the FOMC would have enough certainty, but he expected to learn a lot over the summer.

Therefore, we expect the FOMC to keep the target range for the federal funds rate unchanged at 4.25-4.50% at the meeting on July 29-30 as the majority of the Committee is waiting for more clarity about trade policy and the impact of tariffs on the economy. The expected impact of the tariffs is pulling the Fed in two opposite directions: the upward impact of inflation would be a reason to hike, but the downward impact on economic growth would be a reason to cut. On balance, we think that the Fed will therefore be slow and modest in its reactions. For now, we expect only one rate cut in the remainder of the year, most likely in September.

The Fed succumbs to Trump’s pressure in 2026

While the Fed remains paralyzed by its tariff dilemma, we have seen the first signs that Fed independence is not guaranteed beyond Powell’s reign. The preference of Waller and Bowman to cut rates in July is an ominous sign. Both Governors were appointed by Trump during his first term, but unlike Powell they don’t want to wait for more clarity in the data anymore.

Governor Waller is a creative economist who came up with a theory why the Fed’s hiking cycle could bring the labor market in equilibrium without causing a recession. His view turned out right. So his preference for a July rate cut could just reflect his economic view that tariffs won’t cause inflation. However, it could also be an attempt to get on Trump’s shortlist for the new Fed Chair. Since Waller is already on the Board of Governors, and therefore a permanent voter in the FOMC, his nomination would make him an instant “Shadow Chair” operating from within the FOMC. His speeches would immediately be as important as Powell’s. If Trump loses his patience with Powell (even more than he already has), this could be one way to neutralize him. Only a few days ago, Waller said he would accept the job if asked by Trump. Waller wouldn’t be the first economist to use his creativity to tell those in power what they want to hear.

Meanwhile, Governor Bowman’s rebirth as a dove is outright astonishing. In September 2024 she dissented from the FOMC decision to cut rates by 50 bps because she thought that inflation remained a concern. And now she is in a hurry to cut rates. What happened between then and now that she has turned from the über-hawk to an ultra-dove? Well, last month she was elevated by Trump to Vice Chair for Supervision. A cynical observer might say that there is a quid pro quo in this story.

During the course of 2026 we are going to see one or two additional Trump-loyalists. By the end of January 2026, Adriana Kugler’s term expires and since she is a Democrat there is no chance that she gets another term. What’s more, if Trump is going to nominate a new Chair from outside the current Board of Governors, he may need this spot. In May 2026, Jerome Powell’s terms as Fed Chair expires and it remains to be seen whether he will serve his full term as Governor until the end of January 2028. If he decides to leave the Board as he steps down as Chair, there will be two new Trump-loyalists on the Board. This would mean that Trump-loyalists have a 4-3 majority in

the Board of Governors. Although it is unclear where the voting regional bank presidents stand this would substantially increase the support for rate cuts in 2026.

Until now our forecasts were based on the assumption that the FOMC would be able to resist the pressure from Trump to cut rates further than the Committee would prefer based on monetary policy criteria. The two new Trump appointees would simply be outvoted. However, now that Waller and Bowman seem to have “turned”, the balance of power is likely to shift during the first half of 2026 just enough to give Trump at least some of the rate cuts he wants.

Our new forecasts are shown in table 2. Our forecasts remain more hawkish than what is priced in by markets, although we now converge with markets by the end of 2026. However, if markets are going to price in a decline in the Fed’s independence, our rate trajectory should be well above the market’s trajectory again.

Conclusion

The majority in the FOMC is in no hurry to cut and is waiting for more clarity about government policy and its impact on the economy. The stagflationary impact of the tariffs is likely to pull the Fed in two opposite directions. The upward impact of the tariffs on unemployment would ask for rate cuts to support economic activity. In contrast, the projected rebound in inflation could require rate hikes to slow down aggregate demand and get inflation under control. On balance, we think that the Fed will therefore be slow and modest in its reactions. For now, we still expect only one rate cut in the second half of the year, most likely in September. The current FOMC sees only limited room to come to the rescue of economic activity, because they also have to maintain their credibility as inflation fighters.

However, looking ahead to next year, we expect Trump’s impact on monetary policy to increase as Governor Kugler is replaced before the March meeting and a Trump-loyalist chairs the June meeting. While the remaining FOMC participants should in theory be able to limit Trump’s impact, the recent behavior of Waller and Bowman suggests that Trump has already gained a foothold in the FOMC. This means that we now expect more rate cuts in 2026 than we had earlier anticipated when we assumed that the FOMC would be able to keep monetary policy free from Trump’s influence. We expect the first rate cut of 2026 to take place in March after Kugler has been replaced. The second is likely in June when the FOMC meeting has a new Chair who probably wants to demonstrate to Trump that he was the right nominee (no women are on the shortlist apparently) and will be pushing hard for a rate cut. We have pencilled in two more cuts in September and December.

Note that we do not expect that the Fed will fully lose its independence, because then our new forecasts would go much lower. However, the inclination to cut in 2026 will be higher than we previously thought when we assumed that the Fed would be able to keep monetary policy free from Trump’s influence. Now that Waller and Bowman have “turned”, this is no longer our base scenario.

Disclaimer

Non Independent Research

This document is issued by Coöperatieve Rabobank U.A. incorporated in the Netherlands, trading as “Rabobank” (“Rabobank”) a cooperative with excluded liability. The liability of its members is limited. Authorised by De Nederlandsche Bank in the Netherlands and regulated by the Authoriteit Financiële Markten. Rabobank London Branch (RL) is authorised by De Nederlandsche Bank, the Netherlands and the Prudential Regulation Authority, and subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Further details are available on request. RL is registered in England and Wales under Company no. FC 11780 and under Branch No. BR002630. This document is directed exclusively to Eligible Counterparties and Professional Clients. It is not directed at Retail Clients.

This document does not purport to be impartial research and has not been prepared in accordance with legal requirements designed to promote the independence of Investment Research and is not subject to any prohibition on dealing ahead of the dissemination of Investment Research. This document does NOT purport to be an impartial assessment of the value or prospects of its subject matter and it must not be relied upon by any recipient as an impartial assessment of the value or prospects of its subject matter. No reliance may be placed by a recipient on any representations or statements made outside this document (oral or written) by any person which state or imply (or may be reasonably viewed as stating or implying) any such impartiality.

This document is for information purposes only and is not, and should not be construed as, an offer or a commitment by RL or any of its affiliates to enter into a transaction. This document does not constitute investment advice and nor is any information provided intended to offer sufficient information such that is should be relied upon for the purposes of making a decision in relation to whether to acquire any financial products. The information and opinions contained in this document have been compiled or arrived at from sources believed to be reliable, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness.

The information contained in this document is not to be relied upon by the recipient as authoritative or taken in substitution for the exercise of judgement by any recipient. Any opinions, forecasts or estimates herein constitute a judgement of RL as at the date of this document, and there can be no assurance that future results or events will be consistent with any such opinions, forecasts or estimates. All opinions expressed in this document are subject to change without notice.

To the extent permitted by law, neither RL, nor other legal entities in the group to which it belongs accept any liability whatsoever for any direct or consequential loss howsoever arising from any use of this document or its contents or otherwise arising in connection therewith.

Insofar as permitted by applicable laws and regulations, RL or other legal entities in the group to which it belongs, their directors, officers and/or employees may have had or have a long or short position or act as a market maker and may have traded or acted as principal in the securities described within this document (or related investments) or may otherwise have conflicting interests. This may include hedging transactions carried out by RL or other legal entities in the group, and such hedging transactions may affect the value and/or liquidity of the securities described in this document. Further it may have or have had a relationship with or may provide or have provided corporate finance or other services to companies whose securities (or related investments) are described in this document.

Further, internal and external publications may have been issued prior to this publication where strategies may conflict according to market conditions at the time of each publication.

This document may not be reproduced, distributed or published, in whole or in part, for any purpose, except with the prior written consent of RL. By accepting this document you agree to be bound by the foregoing restrictions. The distribution of this document in other jurisdictions may be restricted by law and recipients of this document should inform themselves about, and observe any such restrictions.

A summary of the methodology can be found on our website

© Rabobank London, Thames Court, One Queenhithe, London EC4V 3RL +44(0) 207 809 3000

Global Economics & Markets

Global Head

Jan Lambregts

+44 20 7664 9669

Jan.Lambregts@Rabobank.com

Macro Strategy

Global

Michael Every

Senior Macro Strategist

Michael.Every@Rabobank.com

Europe

Elwin de Groot Head Macro Strategy Eurozone, ECB

+31 30 712 1322

Elwin.de.Groot@Rabobank.com

Bas van Geffen Senior Macro Strategist ECB, Eurozone

+31 30 712 1046

Bas.van.Geffen@Rabobank.com

Stefan Koopman

Senior Macro Strategist UK, Eurozone

+31 30 712 1328

Stefan.Koopman@Rabobank.com

Maartje Wijffelaars

Senior Economist Italy, Spain, Eurozone

+31 88 721 8329

Maartje.Wijffelaars@Rabobank.nl

Americas

Philip Marey

Senior Macro Strategist

United States, Fed

+31 30 712 1437

Philip.Marey@Rabobank.com

Christian Lawrence

Head of Cross-Asset Strategy

Canada, Mexico

+1 212 808 6923

Christian.Lawrence@Rabobank.com

Mauricio Une

Senior Macro Strategist

Brazil, Chile, Peru

+55 11 5503 7347

Mauricio.Une@Rabobank.com

Renan Alves

Macro Strategist Brazil

+55 11 5503 7288

Renan.Alves@Rabobank.com

Molly Schwartz

Cross-Asset Strategist

+1 516 640 7372

Molly.Schwartz@Rabobank.com

Asia, Australia & New Zealand

Teeuwe Mevissen

Senior Macro Strategist China

+31 30 712 1509

Teeuwe.Mevissen@Rabobank.com

Benjamin Picton

Senior Macro Strategist Australia, New Zealand

+61 2 8115 3123

Benjamin.Picton@Rabobank.com

FX Strategy

Jane Foley

Head FX Strategy G10 FX

+44 20 7809 4776

Jane.Foley@Rabobank.com

Rates Strategy

Richard McGuire

Head Rates Strategy

+44 20 7664 9730

Richard.McGuire@Rabobank.com

Lyn Graham-Taylor

Senior Rates Strategist

+44 20 7664 9732

Lyn.Graham-Taylor@Rabobank.com

Credit Strategy & Regulation

Matt Cairns

Head Credit Strategy & Regulation

Covered Bonds, SSAs

+44 20 7664 9502

Matt.Cairns@Rabobank.com

Bas van Zanden

Senior Analyst Pension funds, Regulation

+31 30 712 1869

Bas.van.Zanden@Rabobank.com

Cas Bonsema

Senior Analyst Financials

+31 6 127 66 642

Cas.Bonsema@Rabobank.com

Maartje Schriever

Analyst ABS

+31 6 251 43 873

Maartje.Schriever@Rabobank.com

Agri Commodity Markets

Carlos Mera

Head of ACMR

+44 20 7664 9512

Carlos.Mera@Rabobank.com

Charles Hart

Senior Commodity Analyst

+44 20 7809 4245

Charles.Hart@Rabobank.com

Oran van Dort

Commodity Analyst

+31 6 423 80 964

Oran.van.Dort@Rabobank.com

Andrick Payen

RaboResearch Analyst

+1 212 808 6808

Andrick.Payen@Rabobank.com

Energy Markets

Joe DeLaura

Senior Energy Strategist

+1 212 916 7874

Joe.DeLaura@Rabobank.com

Florence Schmit

Energy Strategist

+44 20 7809 3832

Florence.Schmit@Rabobank.com